中国中产为何失去信心?(双语 bilingual )Why China''s Middle Class

中国中产阶层为何失去信心?(双语 bilingual )华尔街日报中文

程晓农聊天室:中国1亿中产开始返贫 未来三年将面临巨大财务危机…Why China's Middle Class Is Losing Its Confidence (WSJ); China's 100 million middle class are beginning to return to poverty and will face a huge financial crisis in the next three years...

1. 中国中产阶层为何失去信心?(双语 bilingual )华尔街日报中文 (Chinese)

简体版

2024年4月11日

https://cn.wsj.com/articles/%E4%B8%AD%E5%9B%BD%E4%B8%AD%E4%BA%A7%E9%98%B6%E5%B1%82%E4%B8%BA%E4%BD%95%E5%A4%B1%E5%8E%BB%E4%BF%A1%E5%BF%83-8d2e687b

中国新生一代中产阶层在人生的大部分时间里都认为经济繁荣是理所当然的。但房地产下滑、股市低迷和更广泛的经济衰退已迫使他们面对一个棘手的问题: 中国的繁荣期是否已经彻底结束?

中国民众正在减少支出,增加储蓄,远离高风险投资。

图片来源:QILAI SHEN/BLOOMBERG NEWS

Cao Li

2024年3月26日18:15 CST 更新

三年前,对Blake Xu来说,生活中的一切似乎都很顺利。

那时候,这位33岁的企业家和他的家庭已趁着中国房地产蓬勃发展的浪潮购置了多套房产。他的妻子当时正怀着他们的第一个孩子。他刚刚卖掉了一套住宅,并将几乎一半的卖房所得投入了中国股市。

但从那以后到现在,中国房地产市场进入了长达数年的低迷期,中国基准沪深300指数已跌去了约三分之一的市值,中国经济变得越来越脆弱,消费者信心萎靡不振,民营部门投资疲软,青年失业率居高不下。

Xu已经从中国股市撤出了几乎所有资金。他的下一步可能就是离开中国。

住在上海的Xu说,我不知道未来的路在哪里;等孩子再大一点,我们打算送他出国,也许我们也会出国。

对中国新生一代中产阶层而言,在他们人生的大部分时间里,他们都觉得经济繁荣是理所当然的。但房地产下滑、股市低迷和更广泛的经济衰退已迫使他们面对一个棘手的问题: 中国的繁荣期是否已经彻底结束?

中国人正在减少支出,增加储蓄,远离高风险投资。中国央行的数据显示,截至2月份,国内家庭储蓄达到19.83万亿美元,创下历史最高纪录。消费者信心接近几十年来的最低水平。

中国的城市居民和白领阶层越来越忧心忡忡,这对中国政府来说可能是个大问题。多年来,中国政府的正当性一直来自于在经济治理方面的良好声誉。

现在,这一声誉渐渐开始遭到质疑。

寻找离场策略

在前领导人邓小平删除了毛泽东思想中最激进的内容,并向全球贸易敞开了中国的大门之后,中国经济开始腾飞转型,30岁的Hugo Chen就出生在这一转型期的早期阶段。

Chen在富裕的沿海城市深圳长大,曾在英国攻读硕士学位。2017年,他回到中国从事金融工作,和许多中国人一样,他决定炒股。他还购买了债券,投资了一些保险产品。

但去年他做出了一个决定:不再投资中国股票。

银行家Chen曾为一家保险公司管理资金。他比大多数人更了解投资,他也更清楚,继续投资中国似乎不再是个明智选择了。

截至2023年底,沪深300指数已连续三年下跌。更糟糕的是,美国、日本和其他地方的股市已经飙升。这本该是属于中国的世纪,但中国的经济和股市却在跑输其他国家。

“变穷是一回事。在别人致富的同时自己却变穷,这又是另一码事,”Chen说。

他将大部分投资转向购买美国股票的基金。

中国有超过2.2亿的散户投资者,这意味着股市的走势会对国民心理产生巨大影响。这些小投资者一度被称作赌徒。经历过去几年的低迷之后,他们缩减了投资,逐渐转向货币市场基金等更安全的资产。

房地产行业对信心的损害更大。中国政府大约三年前启动的房地产去杠杆行动已演变成一场持续多年的危机,将数十家开发商推向了倒闭的边缘,中国经济增长的主要引擎之一因此受到冲击。

2月份,中国最发达城市的二手房价格同比下跌6.3%,创下有记录以来最大单月同比跌幅。

前述企业家Xu又卖了一套房,他说这个过程非常痛苦。但他并不后悔。他说,手里有了这笔钱就可以灵活应对,如果情况变得更糟,他可以离开这个国家。

“从情感上讲,我对这个国家抱持最好的希望,”Xu说。“但是,坦白讲,如果这个领导团队继续留任,我必须有一个退出策略,因为前景令人担忧。”

让中国官员不安的正是这种情绪。尽管中国政府牢牢掌控着权力,但对公众情绪十分敏感。

中国民众有公开表达异见的历史,包括公开抗议银行和企业。北京方面至少容忍了一定程度的异见,前提是公民遵循一条首要原则:不要指责中央政府。

但是,一些民众确实将当前的经济问题归咎于中国政府,称政府对互联网公司、课外教培、房地产行业的政策发生了180度大转弯,还实施了严格的新冠疫情防控措施,后者对中国民众的信心造成了持久的伤害。

麻省理工学院(MIT)斯隆管理学院(Sloan School of Management)全球经济与管理学教授、威尔逊中心(Wilson Center)研究员黄亚生说,当前向低投资、高储蓄的转变助长了中国经济的恶性循环,也就是说,经济不景气会削弱信心水平,而反过来,信心不足又会加剧经济下滑。

他说:“当一个社会形成了某种特定的心理,要想转变就不容易了。”

从希望到恐惧

现年37岁的Scarlett Hu还记得2014年回到中国的感觉。当时她刚从国外留学回来,在上海的奢侈品行业找到了一份工作。

Hu说,当时,社会上的每个人都充满希望。周围弥漫着一种积极向上的氛围。Hu说,下班后他们出去放松时,相信明天会更好,今天就玩得开心点。

Hu于2017年在上海买了一套公寓,并在2020年,也就是她儿子出生之前,开始购买投资股市的公募基金。她希望这笔钱能帮助支付儿子的教育费用。这在当时似乎是明智之举:彼时房地产市场欣欣向荣,股市接近创纪录高位,官方媒体高声唱多。

现在,她的公寓贬值了15%,她买的公募基金投资组合下跌了35%。

“现在,我们谈论的是让未来更加确定的具体计划和措施,主要是增加安全感的各种办法。再也感觉不到那种闯劲了,”她说。

中国政府已采取措施应对经济下滑,包括放宽面向房地产企业的贷款规定、降低借贷利率以及承诺解决地方政府的债务问题。但中国政府似乎不愿采取西方国家政府为应对新冠疫情所采取的直接刺激措施;当时西方国家直接向消费者发放现金的做法带动消费重新回到了正轨。

今年3月初,中国总理李强表示,中国政府2024年的经济增长目标是5%左右。最近经济领域也出现了一些改善的迹象。

但有经济学家认为,中国政府将很难实现这一目标,在中国的一些人士担心情况会变得更糟。

一名现年40岁驻北京的股票分析师说,去年8月,她所在的咨询公司倒闭,她也因此失去了工作。她有两个孩子需要照顾,丈夫的收入也不稳定,她预计未来的日子会更痛苦。

“每个人都在说,接下来的10年,一年会比一年糟,所以我们应该做好长期艰苦奋斗的准备,”她说。

*

2. 程晓农聊天室:中国1亿中产开始返贫 未来三年将面临巨大财务危机…(in Chinese)

https://www.youtube.com/watch?v=av2yVLvZ8xI

政经最前线

Mar 31, 2024

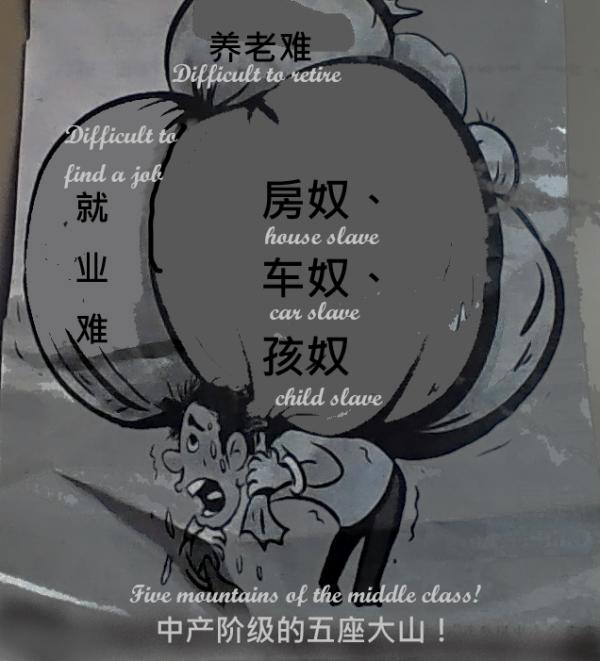

随着中国房地产危机的爆发,最近胡润研究院发布《2024胡润全球富豪榜》,共有3279位「10亿美元」级的富豪企业家上榜,中国虽占814人排行第1,却比去年减少155位富豪,专家分析,中国富豪财富缩水,其实是这些富豪透过管道将财产转移到海外做投资跟避险,所以,实际上真正影响到的是走也走不了的中国中产阶级。 现在的中国中产阶级,很多都是背负按揭而成为负债一族,他们被迫考虑是否要割肉抛出,不求润只求稳,就因这样的现象越愈来愈多,中产阶级泡沫在中国似乎正在慢慢破灭中,甚至绝大多数的中产阶级已经开始「返贫」成「中惨」… 这集我们要讨论的是何谓中产?有车有楼的能称中产吗?其实,中产是有界定的,全球不同组织或机构,对中产定义都有不同,2024年的中产指标又是如何计算?你在其中吗?而中产返贫是否只在中国?世界其他国家的中产,若以美中台中产相较,结过会是... ? 含金量最高 最精彩的内容 程晓农博士为您权威剖析 👉 中产资产正在崩塌…中国即将面临消失的中产! 👉 台湾中产比例高不高? 美国中产正在减少! 👉 美中台中产相比较 👉 中国中产变中惨!

*

月光族过年

上联:年年难过年年过,

下联:月月愁光月月光。

横批:小康早至 [Mark Wain 2024-04-14]

https://blog.creaders.net/user_blog_diary.php?did=NDg2NTg3

Translations:

1. Why China's Middle Class Is Losing Its Confidence

The country's economic miracle created an optimistic middle class. A slowdown has left it shaken.

Cao Li

03/26/2024

Three years ago, everything seemed to be going right for Blake Xu.

The 33-year-old entrepreneur and his family had built a portfolio of properties during China's real-estate boom. His wife was expecting their first child. He had just sold an apartment, and put almost half of the proceeds into the stock market.

Since then, the property market has entered a yearslong downturn, the country's benchmark CSI 300 stock index has lost around a third of its value and the economy has become increasingly vulnerable, suffering from moribund consumer confidence, weak private-sector investment and sky-high youth unemployment.

Xu has already pulled almost all of his money out of China's stock market. His next exit may be from China itself.

“I don't know where the future path lies,” said Xu, who lives in Shanghai. “Once our child grows a little older, we intend to send him abroad, and perhaps we will also go.”

For most of their lives, China's new generation of middle-class citizens could take a booming economy for granted. But the property rout, the stock-market slump and the wider economic downturn have forced them to confront a difficult question: Are China's boom years over for good?

Chinese citizens are spending less, saving more and shying away from risky investments. Household savings in the country reached $19.83 trillion by February, the highest figure on record, according to data from the central bank. Consumer confidence is near its lowest level in decades.

The increasing sense of nervousness among China's city-dwellers and white-collar workers could be a major problem for Beijing. China's government has for years derived legitimacy from its reputation for sound economic management.

Now, that reputation looks increasingly shaky.

Finding an exit strategy

Hugo Chen, 30, was born during the early stages of China's remarkable economic transformation, which came after former leader Deng Xiaoping rolled back the worst excesses of Maoism and opened the doors to global trade.

Chen, who was raised in the wealthy coastal city of Shenzhen, studied for a master's degree in the U.K. He moved back to China in 2017 to work in finance and, like many Chinese citizens, decided to play the stock market. He also bought bonds and invested in insurance products.

But last year, he made a decision: no more Chinese shares.

Chen, a banker, had previously helped an insurance company manage its money. He knew more than most about investing—and China no longer seemed like a smart place to invest money.

By the end of 2023, the CSI 300 index had fallen for three years in a row. Even worse, stocks in the U.S., Japan and elsewhere had surged. It was supposed to be China's century, but the economy and the stock market were losing ground to those in other countries.

“Becoming poor is one thing. Becoming poor while others get rich is another,” said Chen.

He shifted most of his investments into funds that buy U.S. stocks.

China has more than 220 million individual investors, meaning stock-market moves can have a big impact on the national psyche. These small investors once had a reputation as gamblers. After the slump of the past few years, they have scaled back their bets and increasingly shifted to safer assets such as money-market funds.

The real-estate sector has done even more damage to confidence. What started as an attempt by Beijing to rein in excessive debt in the sector around three years ago has morphed into a multiyear crisis, pushing dozens of developers to the brink of collapse and pulling the rug out from under one of China's main drivers of economic growth.

The price of existing homes in China's most developed cities fell 6.3% in February compared with the same month last year—the biggest year-over-year decline on record.

Xu, the entrepreneur, sold a second property in a process he described as extremely painful. But he has no regrets: The money will give him the flexibility he needs to leave the country if things get worse, he said.

“Emotionally, I hope for the best for this country,” said Xu. “However, if this team of leaders stays, to be frank, I have to have an exit strategy, as the outlook is worrisome.”

That is precisely the kind of sentiment that will unsettle officials in Beijing. Although China's government keeps a tight grip on power, it is acutely sensitive to the public mood.

China's population has a history of public displays of dissent, including public protests against banks and companies. Beijing has tolerated at least a degree of dissent, as long as its citizens follow one overriding principle: Don't blame the central government.

But some people in the country do blame Beijing for the current economic troubles, pointing to policy U-turns on internet companies, private education and real estate, and a strict approach to containing Covid-19 that has dealt lasting damage to confidence in the country.

The shift toward low investment and high savings is fueling a vicious cycle, where the economic slump erodes confidence levels and, in turn, low confidence worsens the downturn, said Yasheng Huang, professor of global economics and management with MIT Sloan School of Management and a fellow at the Wilson Center.

“When a society settles on a particular psychology, it's not easy to shift,” he said.

From hope to fear

Scarlett Hu, 37, remembers how it felt to be back in China in 2014. She had just returned from studying abroad, and took a job in Shanghai's luxury-goods sector.

“At that time everyone in the society was full of hope. There was this promising sentiment around,” said Hu. “When we went out to relax after work, we believed that tomorrow would be better and let's have fun today.”

Hu bought an apartment in Shanghai in 2017 and started buying mutual funds that invest in the stock market in 2020, before the birth of her son. She hoped the money would help pay for his education. At the time, it seemed like a smart bet: The real-estate market was booming, and stocks were nearing a record high, cheered on by China's bullish state media.

Her apartment has now lost 15% of its value, and her mutual-fund portfolio is down 35%.

“Now we talk about concrete plans and measures to secure a more certain future, focusing on ways to enhance our sense of security. You don't feel that kind of ambition any more,” she said.

China's government has taken steps to tackle the downturn, including easing lending rules for battered real-estate firms, cutting borrowing rates and pledging to resolve the debt problems of local governments. But Beijing appears reluctant to adopt the sort of direct stimulus Western governments embraced in the wake of Covid-19, when direct payments to consumers helped get spending back on track.

In early March, Chinese Premier Li Qiang said the government was targeting growth of around 5% for 2024, and there have been recent signs of improvement.

But economists think Beijing will find it difficult to hit this growth target, and some people in the country worry that things are about to get worse.

A 40-year-old equity analyst based in Beijing said she lost her job last August when the consulting firm she worked for closed. She has two children to care for, her husband's income is unstable, and she is bracing herself for more pain to come.

“Everyone is saying that this year might still be the best in the next decade, so we should be prepared for a long period of hardship,” she said.

Write to Cao Li at li.cao@wsj.com

2. Cheng Xiaonong Chat Room: China's 100 million middle class are beginning to return to poverty and will face a huge financial crisis in the next three years... (in Chinese)

https://www.youtube.com/watch?v=av2yVLvZ8xI

The forefront of politics and economy

Mar 31, 2024

With the outbreak of the real estate crisis in China, the Hurun Research Institute recently released the "2024 Hurun Global Rich List". A total of 3,279 billionaire entrepreneurs are on the list. Although China ranks first with 814 people, it is less than Last year, there were 155 rich people. According to expert analysis, the shrinking wealth of China's rich is actually due to these rich people transferring their property overseas through channels for investment and risk hedging. Therefore, what is actually really affected is the Chinese middle class who cannot leave. Many of the current Chinese middle class are burdened with mortgages and have become indebted. They are forced to consider whether to cut off their flesh and sell it. They do not seek profit but stability. Because this phenomenon is becoming more and more common, the middle class bubble seems to be in China. It is slowly being destroyed, and even the vast majority of the middle class has begun to "return to poverty" and become "middle miserable"... What we are going to discuss in this episode is what is the middle class? Can those who own cars and houses be called middle class? In fact, the middle class is defined. Different organizations or institutions around the world have different definitions of the middle class. How is the middle class index calculated in 2024? Are you one of them? Is the return of the middle class to poverty only in China? If the middle class in other countries in the world is compared with the middle class in the United States, China and Taiwan, what will be the result... ? The most valuable and exciting content, Dr. Cheng Xiaonong, will give you an authoritative analysis 👉 The assets of the middle class are collapsing... China The middle class is about to disappear! 👉 Is the proportion of the middle class in Taiwan high? The middle class in the United States is shrinking! 👉 Comparing the middle class in the United States, China and Taiwan👉 The middle class in China has become miserable!

3. Moonlight Clan celebrates the New Year

First couplet: Every year is sad and every year passes;

Second line: The moon is full of sorrow and light.

Hengpi: Well-off people arrive early [Mark Wain 2024-04-14]

https://blog.creaders.net/user_blog_diary.php?did=NDg2NTg3